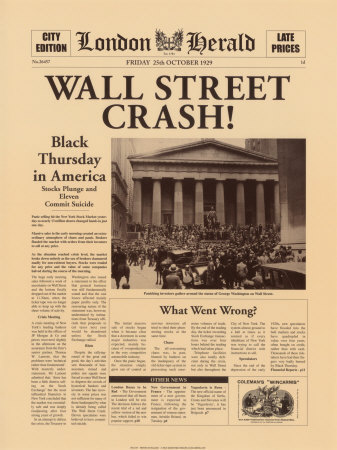

The 1920’s were a time of prosperity in America. The stock market grew at a rapid rate over this decade. This increase provided many investors with high profits. Wall street exploited the growth of the market during this decade. A significant amount of money in the market contributed to the rapid growth of the common stocks. However, this prosperity led to a massive crash in the market.

The large bull market of the 1920’s created the Great Depression. Investors chased rising stock prices. Major banks on Wall Street gambled with their investments. Eventually, these gambles drove stock prices to dangerously high levels. Investors took risks purchasing these growing stocks. Mathematical valuation of the stock prices did not occur. These investors wanted to make a quick profit by trading these growing stocks. They disregarded the fundamentals of valuing these companies and began to speculate.

Speculation is basing decisions on instinct alone. Investing is different because it promotes the use of technical analysis to make decisions. These stocks eventually crashed because they were earning less money than their value. The 1929 crash demonstrates irrational decisions based on instinct. This event showcases the dangers of irrational investing in the stock market.

Image Source: http://www.mattwardman.com/blog/wp-content/uploads/spl3155wall-street-crash-posters.jpg